Chancellor Kwasi Kwarteng has announced permanent stamp duty cuts for some home-buyers in his ‘mini-budget’.

Stamp duty is a tax payable to the government when you buy a home, or land, priced above a certain threshold in England or Northern Ireland.

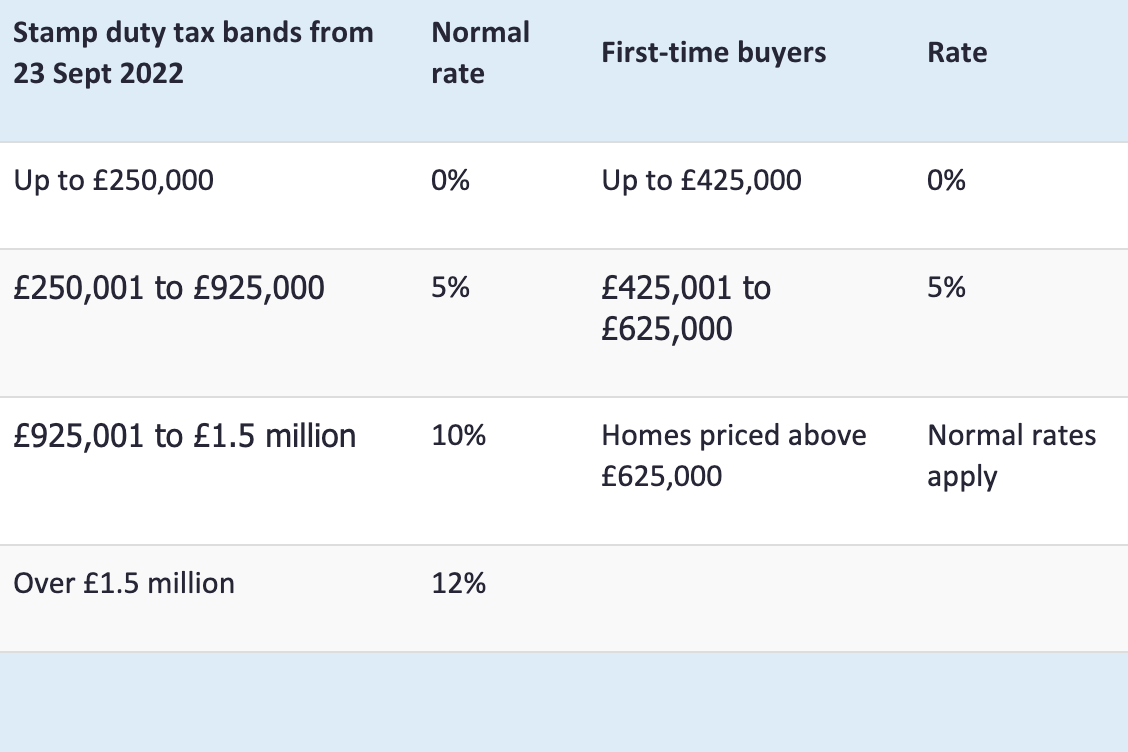

Previously, you would pay stamp duty tax on a home, or the portion of a home, priced between £125,001 and £250,000. Following today’s announcement, no stamp duty is payable below the price threshold of £250,000.

This means a third of all homes currently for sale (33%) are now completely exempt from stamp duty in England, compared to 7% when the threshold was £125,000.

Before today, first-time buyers paid no stamp duty on the first £300,000 of a home purchase. This has now been raised to £425,000. And if the home you’re buying is priced below £625,000, you’ll still pay no stamp duty on the portion of the property priced below £425,000, and 5% on the portion priced above this. This is an increase of £125,000 on the previous price cap of £500,000.

These changes will reduce stamp duty bills across the board for all home-movers by up to £2,500, with first-time buyers able to save up to £11,250.

The cuts also mean that two thirds of homes (66%) are now exempt from stamp duty for first-time buyers in England.

What are the stamp duty rates now?

How might the stamp duty cuts impact the housing market?

“If the stamp duty cuts lead to a big jump in prospective buyers competing for the constrained number of properties for sale, then it could lead to some unseasonal price rises over the next few months. But because the change is permanent, and because of gathering headwinds such as rising mortgage rates, we expect to see a more gradual increase in demand compared with the surge when the temporary stamp duty holiday was announced in 2020.”

“With more buyer demand we would also expect that the current trend of more properties coming to market will continue, offering more choice for buyers,” he adds.

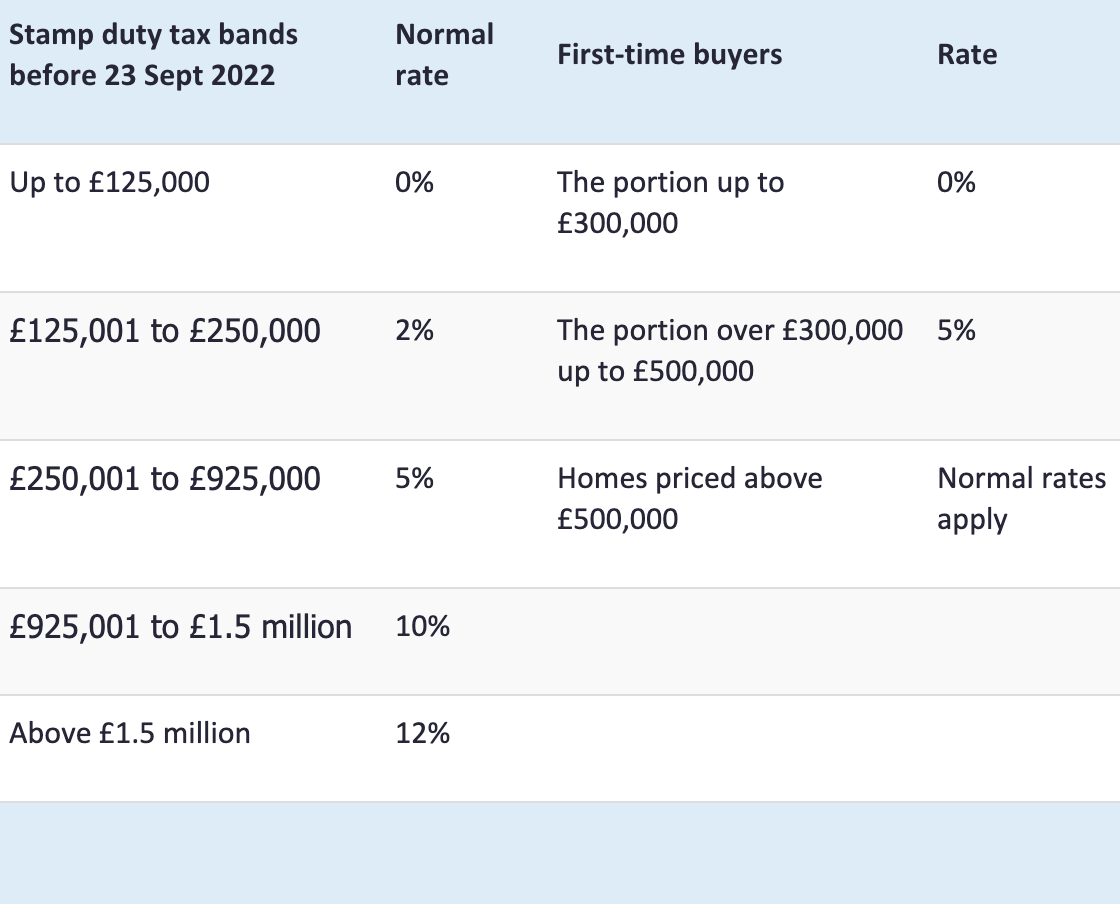

What were the stamp duty rates in England and Northern Ireland before today?

No stamp duty was payable on homes, or the portion of a home, priced at or below £125,000. First-time buyers didn’t pay any stamp duty tax on homes priced below £300,000.

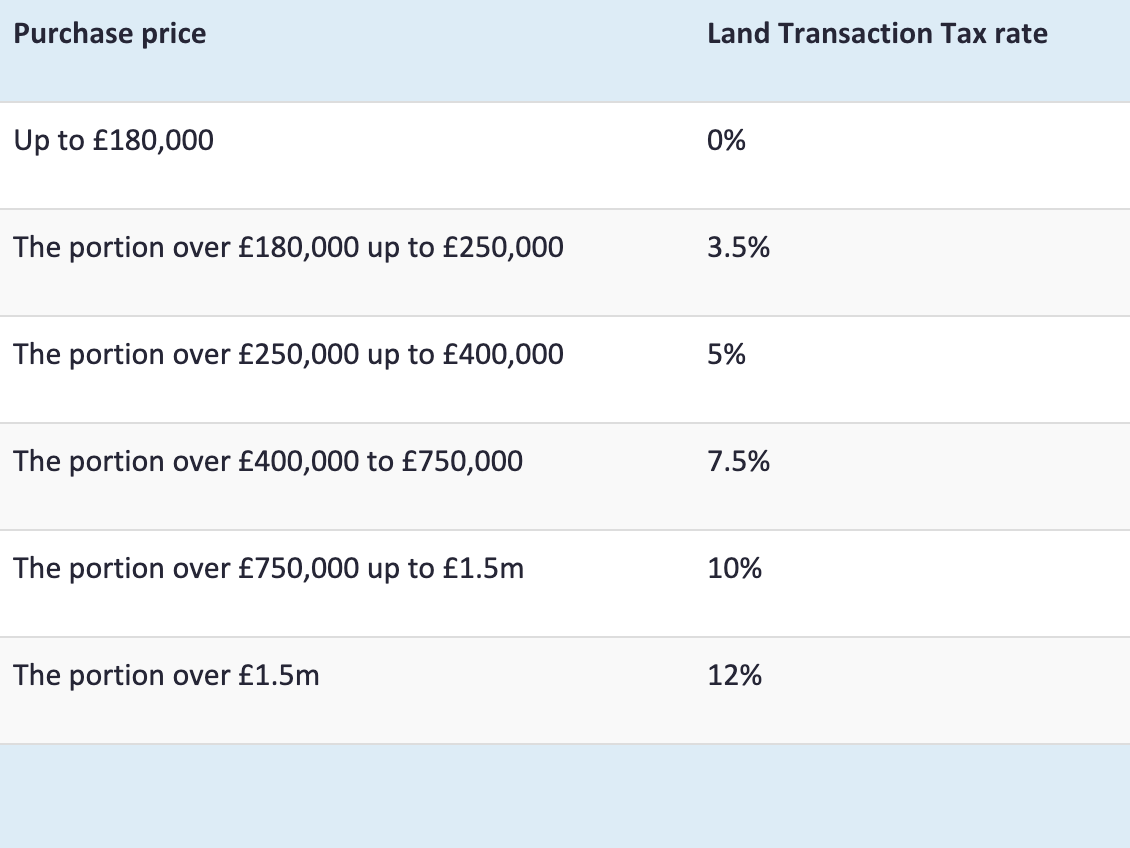

How much is stamp duty in Wales?

In Wales, Stamp Duty is called Land Transaction Tax (LTT).? First-time buyers pay the same amount as other home-movers. There’s a nil-rate threshold for buyers of homes priced below £180,000. LTT is then charged at the rates below:

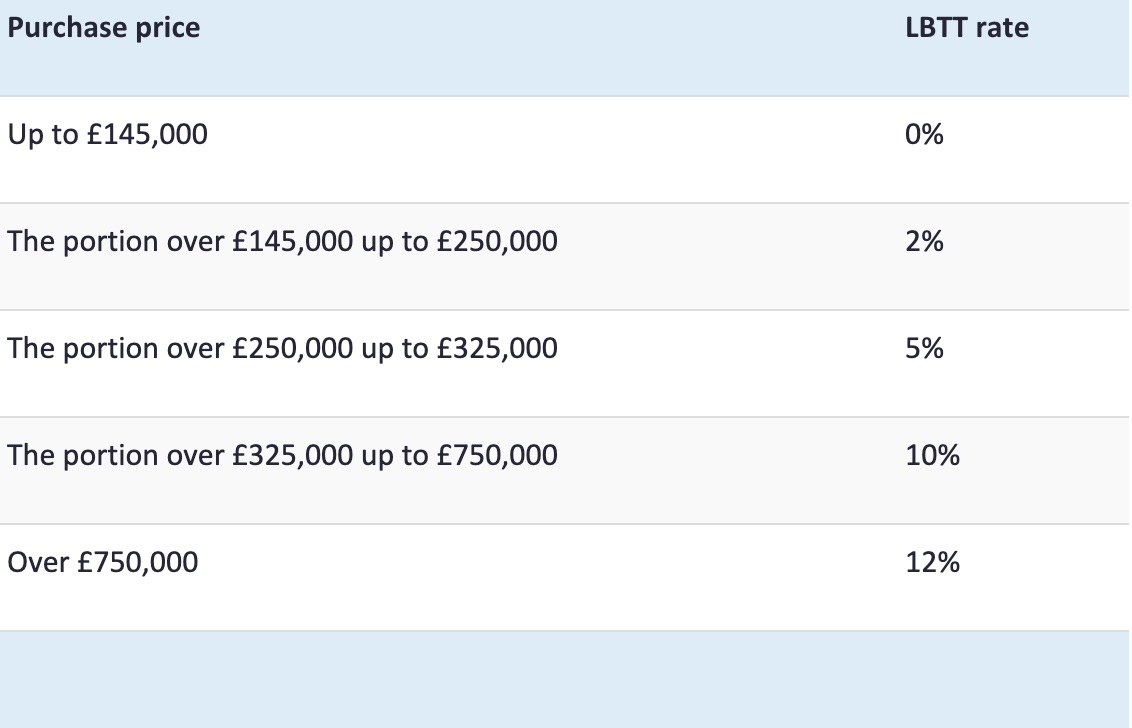

And in Scotland?

In 2015, Land and Buildings Transaction Tax (LBTT) replaced Stamp Duty Land Tax in Scotland.

Source Rightmove